Official data suggest investors taking advantage of the tax system are helping to drive property prices higher and locking out first-time buyers.

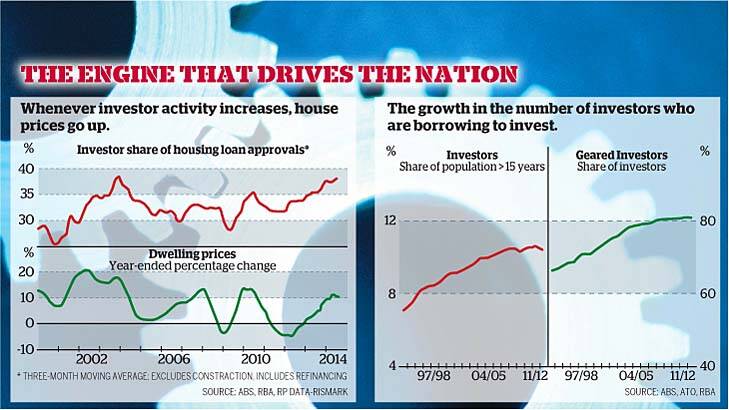

In its Financial Stability Review this week, the Reserve Bank of Australia showed a correlation between investor activity and stronger property prices.

Investor housing loan approvals account for almost 40 per cent of the total value of housing loan approvals, the highest it has been for 10 years.

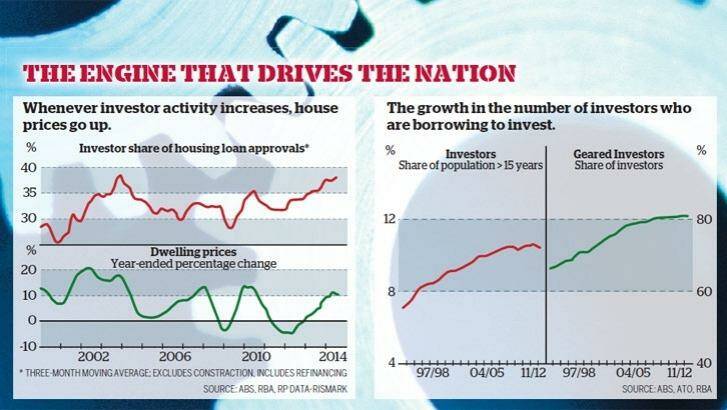

The most recent data from the Australian Tax office shows 1.3 million taxpayers reported losses on investment property for the 2011-12 year, or about two-thirds of all those with an investment property.

The average loss for 2011-12 was just under $11,000. Negative gearing is where the income from rent from the property is less than the costs of the investment, which includes the interest of the investment loan and other expenses.

Loss-making investors are hoping to be able to eventually sell the property for a price that more than makes up for the losses incurred along the way.

Australia is one of the few countries among those with similar tax systems to allow negative-gearing losses on all income-producing assets, not just property, to be offset against investors' other income.

It is seen as particularly generous to investors, given the capital gains on which capital gains tax applies is discounted by 50 per cent as long as the investment is held for at least a year.

The Abbott government has said it wants a review of the tax system, though it is yet to outline the scope or timing of the review. Any review would almost certainly revisit the question of negative gearing.

This week, the Housing Industry Association released a report it commissioned that shows removing negative gearing would exacerbate housing supply problems and cause rents to rise. The Association said removing stamp duty would be a better way of improving housing affordability than removing negative gearing.

Stamp duty is the often-high fee paid to a state government for buying a property. The report said an estimated $7 billion was paid in stamp duty on residential property conveyances in 2011-12.

However, Saul Eslake, chief economist at Bank of America-Merrill Lynch Australia, said negative gearing does not do much to improve housing supply because most geared investors buy established housing. He says the argument that negative gearing improves the supply of affordable rental housing is without foundation.

Eslake says the Reserve Bank's Financial Stability Review shows it is investors who are drivingup house prices to the detriment of would-be first-home buyers. Negative gearing is tricky politically given that so many people now take advantage of the tax break.

In the mid-1980s when the Hawke government restricted negative gearing, the decision was reversed less than two years later following a sustained campaign by the property industry.

At the time, the property industry claimed that rents went through the roof. The data shows rents rose but only in Sydney and Perth and that was because of low vacancy rates in the two cities, Eslake says.

If the removal of negative gearing was the cause, rents should have risen everywhere, he says.

Peter Bembrick, tax partner with accountants and advisers HLB Mann Judd Sydney, says anyone thinking of negatively gearing a property should be careful.

Losses from negative gearing are still losses and 'positive' gearing, where the rental income exceeds the costs, is always preferable. Bembrick says property investing for capital growth, especially in the current market where prices have risen strongly, has to be a long-term proposition.

When mortgage interest rates rise, as they will from their record lows, some investors could face cash-flow problems, he says. Investors never want to be forced sellers because they cannot meet the holding costs, Bembrick says.